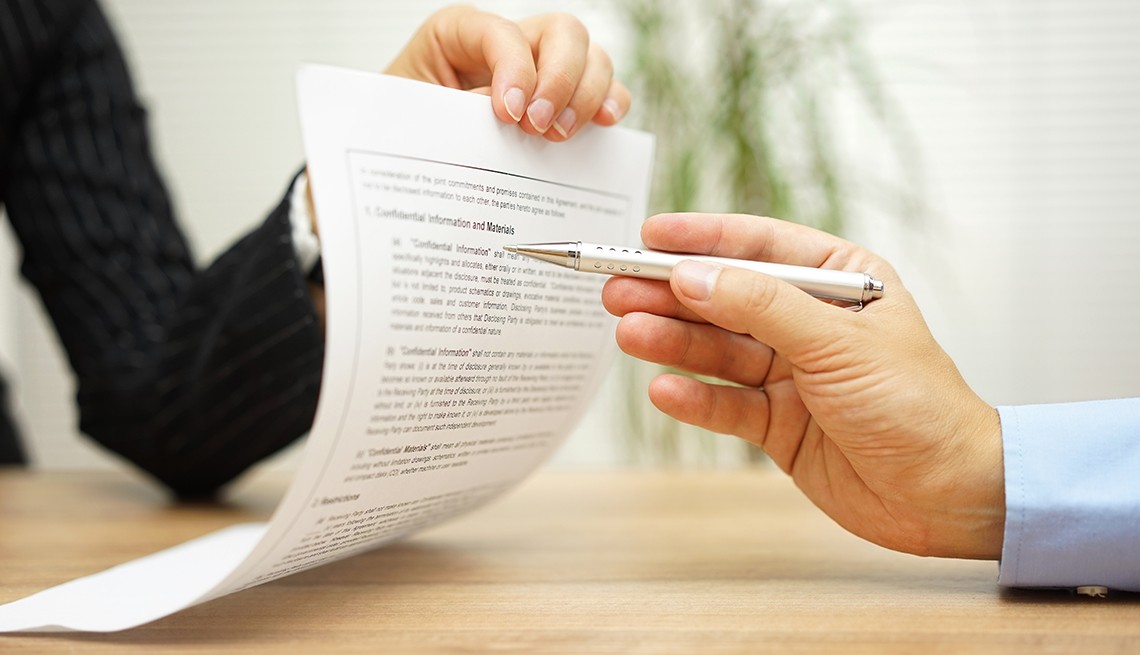

The Link Between Insurance and Legal Protection

Insurance and legal protection are deeply intertwined, forming a critical safety net for individuals and businesses alike. While most people think of insurance as a financial buffer against accidents, illness, or property damage, its role in shielding policyholders from legal exposure is equally important. In many cases, insurance doesn’t just pay for losses—it also provides … Read more